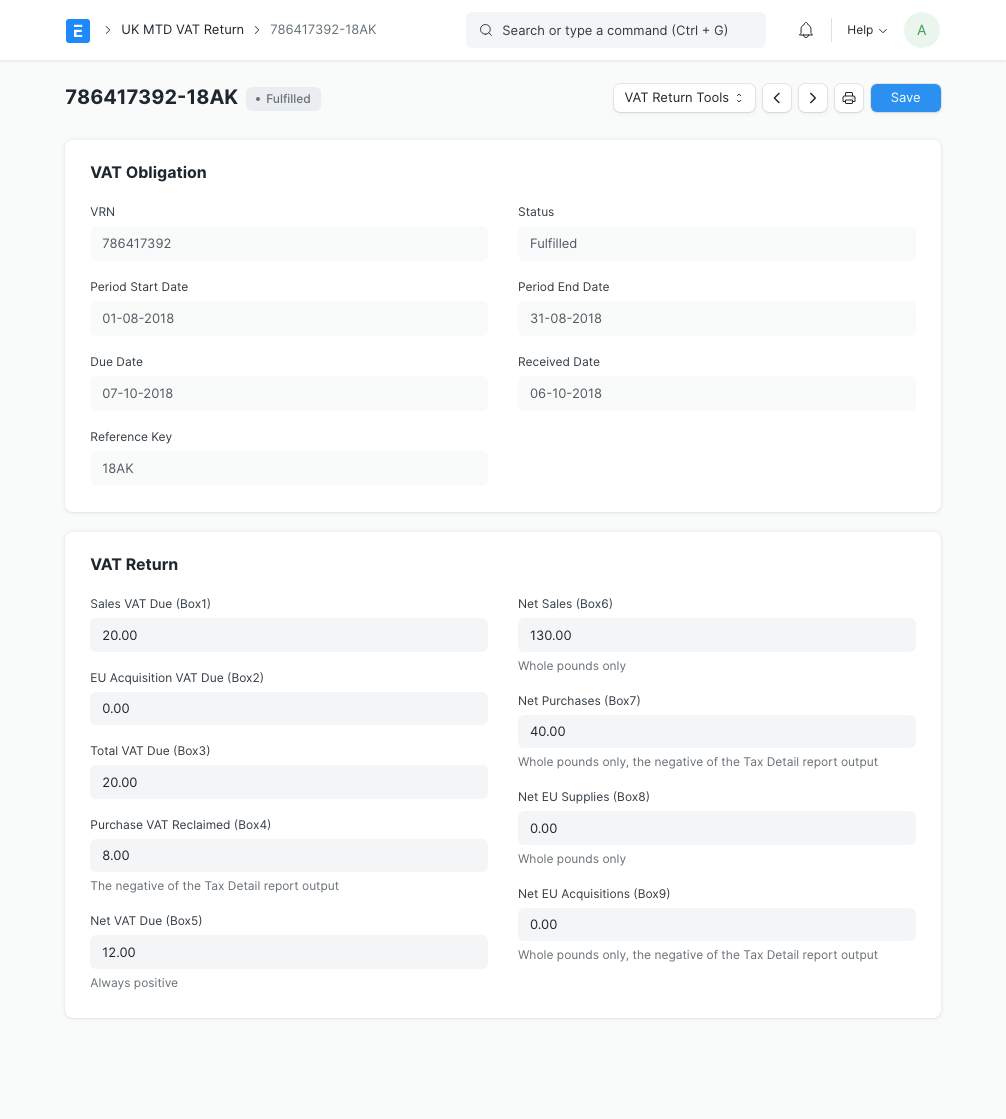

The VAT Return report will generate the figures for the 9-boxes on the standard VAT Return

Once authorised through the Government Gateway, the figures can be submitted directly to HMRC from ERPNext

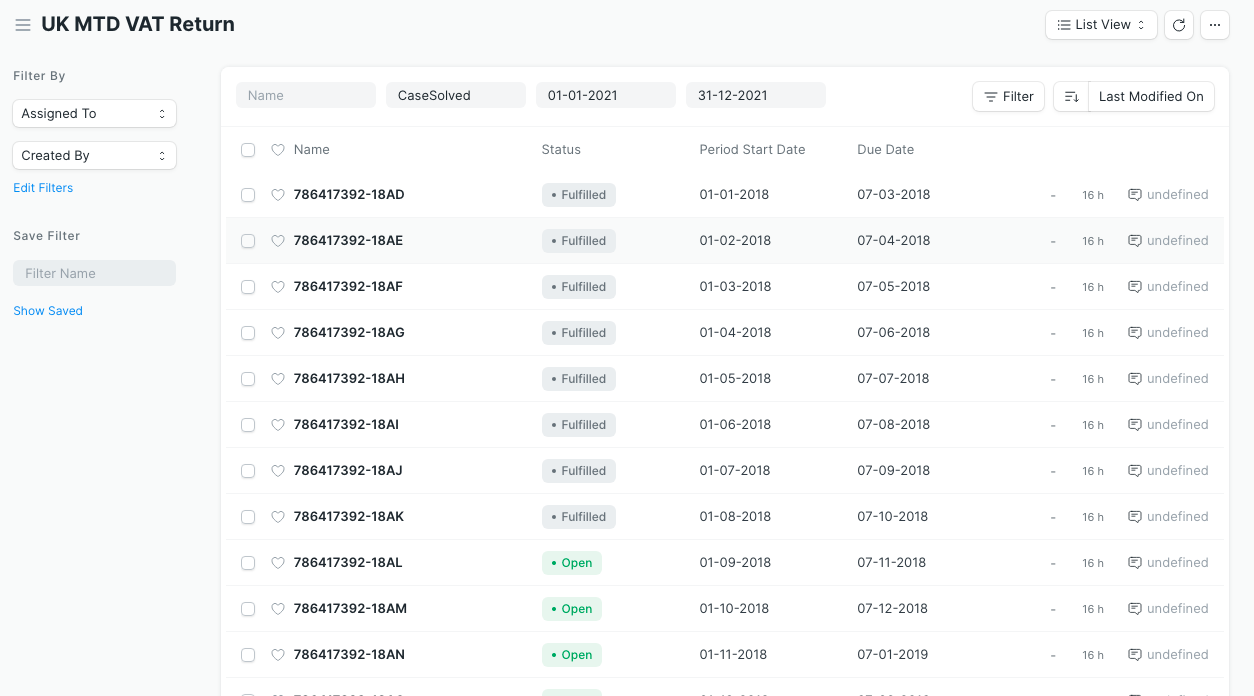

The same interface will allow you to view your previous VAT Returns, VAT Return obligations, liabilities and payments

Support for EU trade and reverse charge VAT reporting rules is built-in

Per-line VAT that supports standard, reduced and zero rated items

Simple VAT categorisation of all your trading entities means zero duplication of information but correct VAT records

To err is human, so fix any problems with standard Journal Entries affecting your VAT accounts and the report does the rest

The UK has introduced a new initiative for digital tax submissions named Making Tax Digital (MTD). The first service to go live and be mandated from 2019 for all VAT-registered UK businesses was for VAT.

It is possible to configure vanilla ERPNext to produce the general ledger entries to support the figures required by the UK VAT return 9-box structure in its Chart of Accounts. However, there is no built-in report to extract the figures easily. MTD for VAT submissions to HMRC must also be done outside ERPNext.

Available since 2021, our integrated ERPNext extension is now HMRC Recognised (look for CaseSolved) and available for free, you just pay per submission. Have a look at the screen shots or video below!

Support is available through our uk-support github page

Further details can be found in our Terms & Conditions

This animation of the VAT Report shows some steps in creating a suitable VAT report from your ledger entries. Once created you can simply run the same report with different dates.

This is the VAT Return submission interface which looks just like any other ERPNext document page. The return page has a tool menu at the top where you can retrieve the result of the custom VAT Report for the obligation period. Or alternatively, if you use a non-standard VAT scheme, you can simply enter your own values.

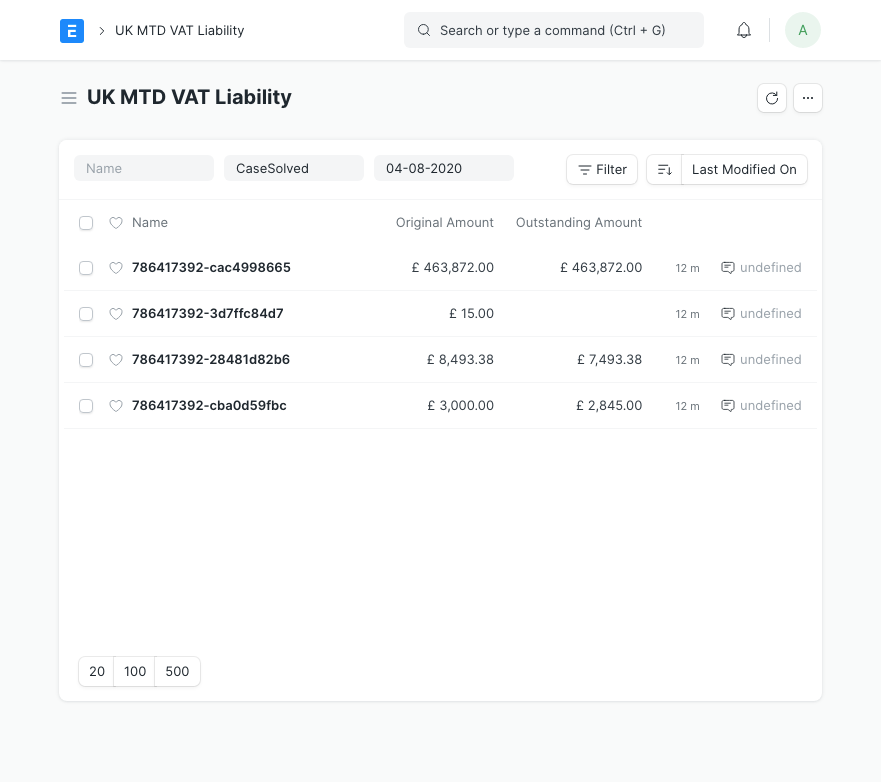

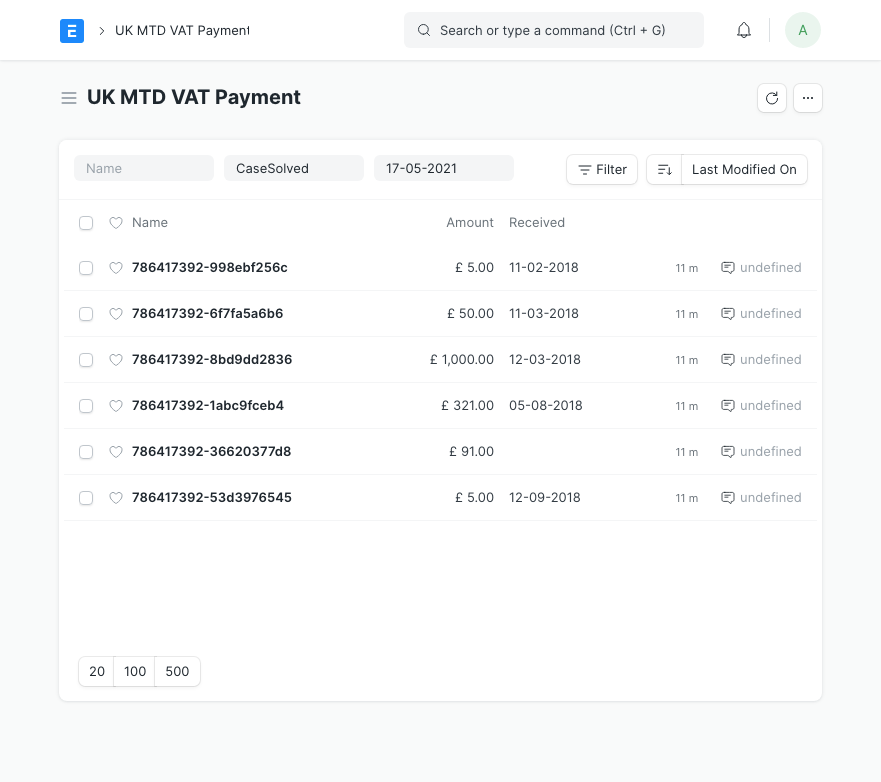

Your liabilities & payments below are automatically retrieved.

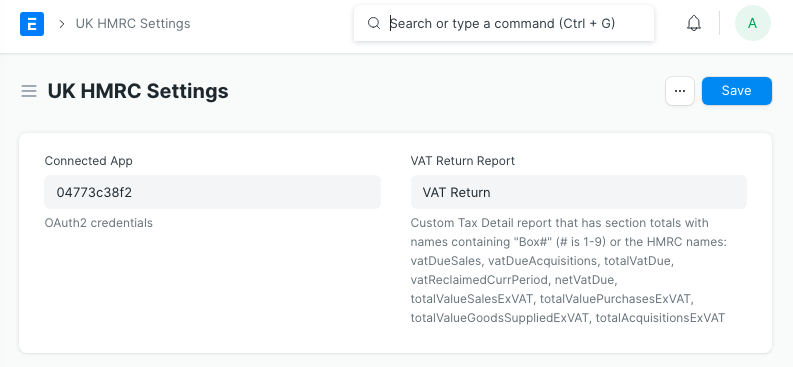

Just two simple steps to get up and running:

- Authorise via the Connected App feature with your Government Gateway credentials

- Create and attach your custom VAT Return report.

Everything is organised in the new UK workspace.